Yanis and the Enchanted Cloud

I was rather busy and downcast for quite a long time, so was not very familiar with this Technofeudalism theory promoted by Yanis Varoufakis since 2021. Now that he finally wrote a book on this matter, and the book is out (hardcover and e-book), I’d thought of mentioning this right away.

How I found out

This was not the video that made me aware of Yanis’ new concept and new book; but this one is made of straightforward excerpts. Sorry for having had to embed a Facebook video; I hope it plays in your browser too.

Here’s the video from which the above outline has been extracted:

2023-09-30: Times Radio: Capitalism is over and ‘social democracy is finished’ | Yanis Varoufakis

2023-09-30: Times Radio: Capitalism is over and ‘social democracy is finished’ | Yanis Varoufakis

The first video I watched was this other one:

2023-09:29: Channel 4 News: Yanis Varoufakis on the death of capitalism, Starmer and the tyranny of big tech

2023-09:29: Channel 4 News: Yanis Varoufakis on the death of capitalism, Starmer and the tyranny of big tech

At the time, I posted the following comment on Facebook:

Varoufakis says what we’re living in isn’t capitalism anymore! Some ideas from the first 20 minutes:

1. Capitalism has been replaced by technofeudalism. Technofeudalism is a mutation of Capitalism known as Cloud Capital. It’s a technologically advanced version of traditional capital.

2. Technofeudalism is based on enormous capital quantities. But in this new society, people contribute to capital without being paid as wage laborers! These Cloud serfs are engaged in voluntary serfdom! People voluntarily contribute to platforms like Facebook, producing capital for free.

3. The macroeconomic significance of capital being reproduced without wage labor (it’s unpaid work, really) in the digital age: in a normal wage labor economy, wages being paid, these wages contribute to the increase of the demand in the marketplace; when the Cloud serfs are producing capital without being remunerated, that shrinks the aggregate demand. That means that the central banks have to print more money. This is why today, when there’s already inflation, the central banks are “in a state of apoplexy”: they don’t know what to do.

4. The demarcation between work and leisure has disappeared. Young people are anxious about their presence in the social media, because they know that when they apply for a job, the HR will look at their social media. So they’re constantly trying to create the Self that they’re going to sell in the labor market. But that means there’s no autonomy for the liberal individual anymore. It also means that we have no social democracy.

5. Opting out of this digital engagement and becoming a new Luddite is possible, but not a societal solution, it can only work for the individual; it can’t be an escape for the humanity.

6. It cannot be capitalism without two pillars: markets; and profits (that lubricates capitalism). Both are now “optional”; now profits can be collected without productive work, with no entrepreneurial activity. The current system is dominated by digital platforms (digital fiefdoms replaced the markets) and by rent collection (not profits per se). Jeff Bezos is collecting rents (EDIT: Apparently, this is not about Amazon Web Services; Varoufakis claims that Amazon is charging a 40% fee on the sales, thus accumulating “Cloud rent”?! Either way, the Cloud Capital sells directly, bypassing markets and capitalism). This cannot accurately be described as capitalism.

7. We have a very different world now. The difference between Tesla and traditional car manufacturers like Volkswagen. Switching to EVs, VW has created another Tesla, because there’s no Cloud Capital in Germany. Tesla, and BVD, etc. depend on the Cloud Capital (I’m not sure what he means: are they selling because of the buzz in the social media?!), something Germany lacks. This applies to Europe and Britain too, which are now increasingly irrelevant in the technology sector without Cloud Capital. Only China and the United States matter.

8. We need to socialize Cloud Capital, making it accessible to those who produce it, e.g. by granting employees one share each upon employment, which cannot be traded or leased. This is the same way you can have one vote in the general elections. A real shareholder democracy, while keeping a market-based system, without the following two markets: the shares market (as long as one can’t trade the shares), and the labor market (because there’s no difference between being a worker and being an owner). «« I’m not sure if I understood how this works!

So there’s no difference between property and wages. «« My head is spinning here too!

To be reexamined.

There is a book, after all

Yes, this is about his latest book, Technofeudalism: What Killed Capitalism (Hardback edition Sept. 28, 2023).

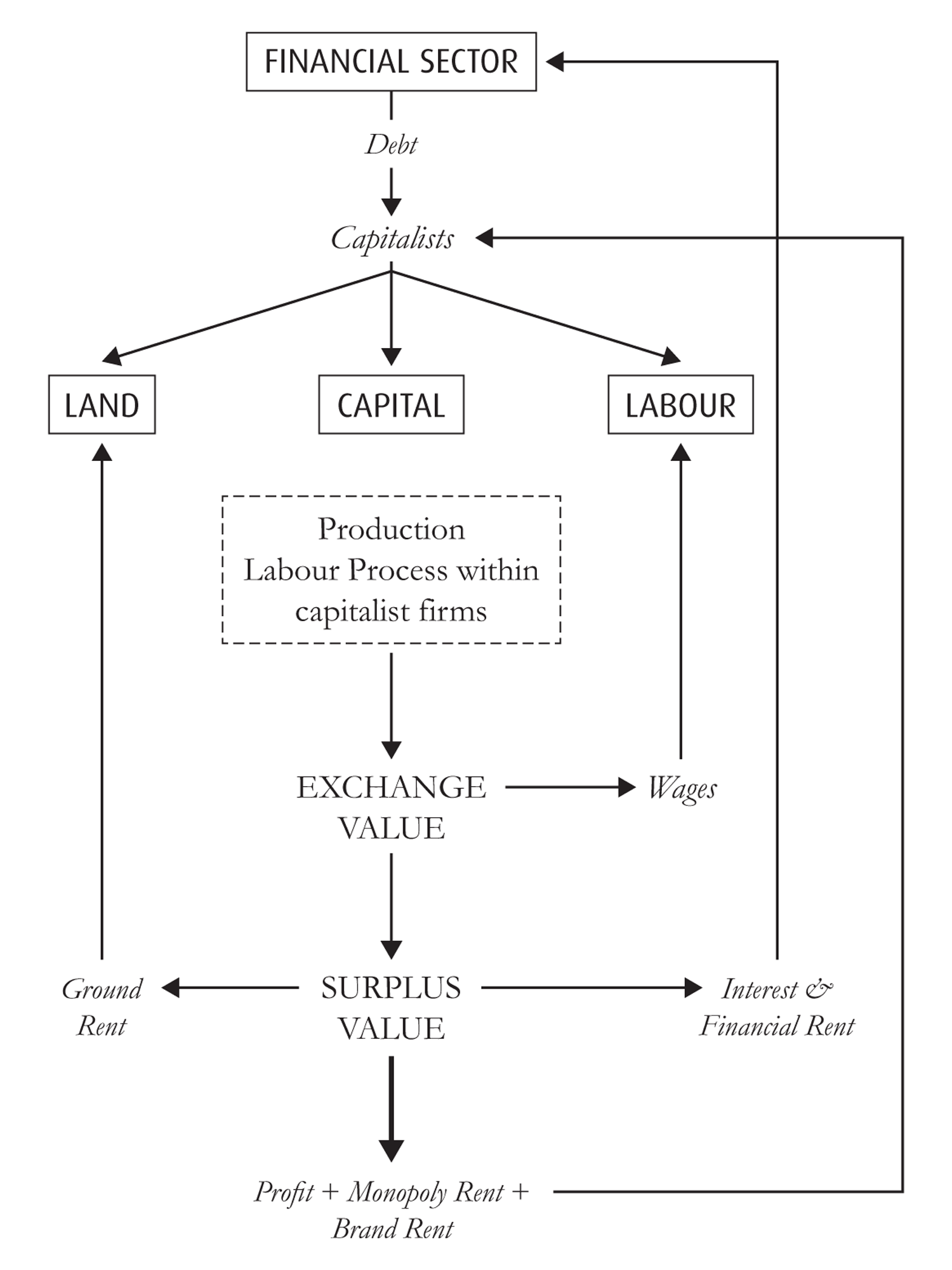

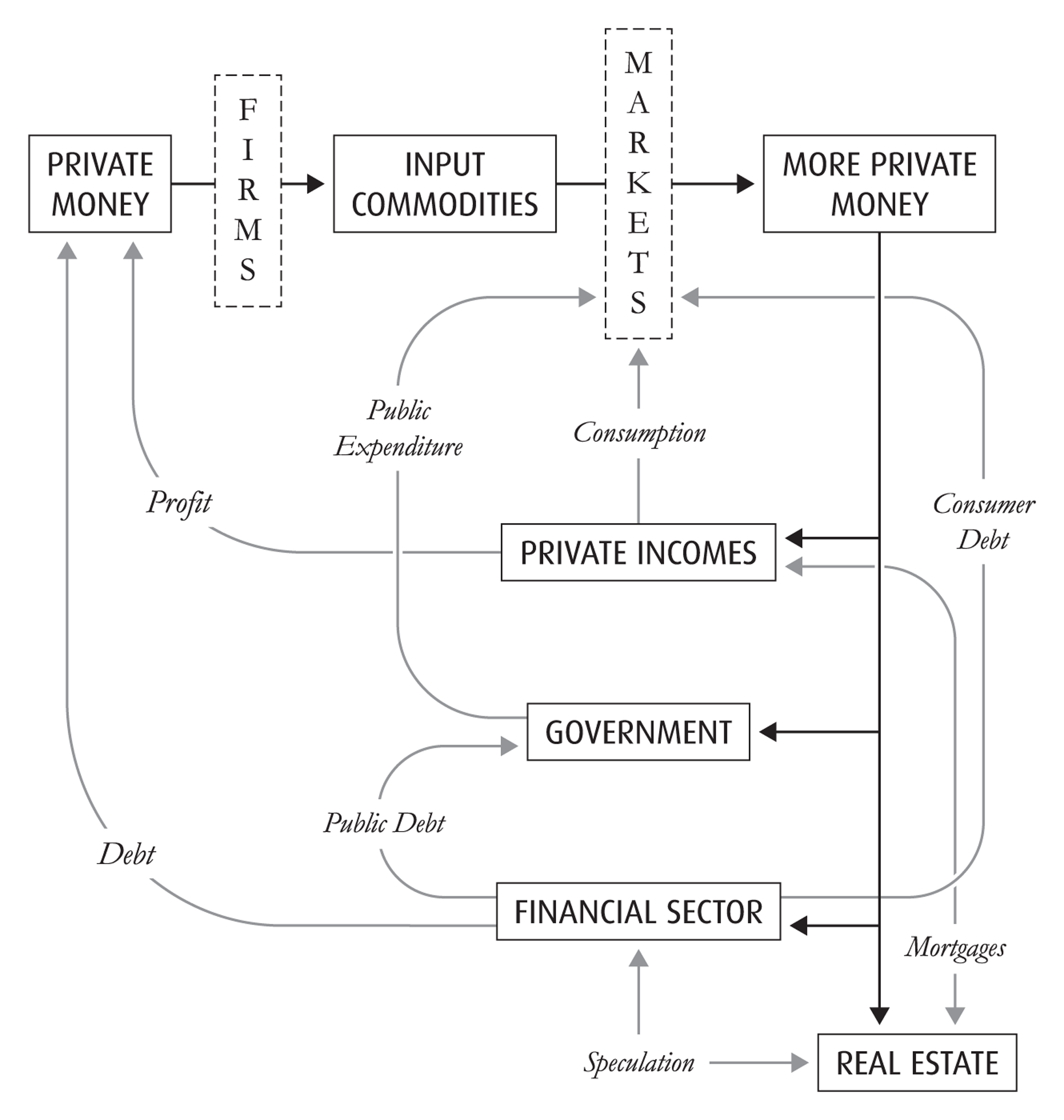

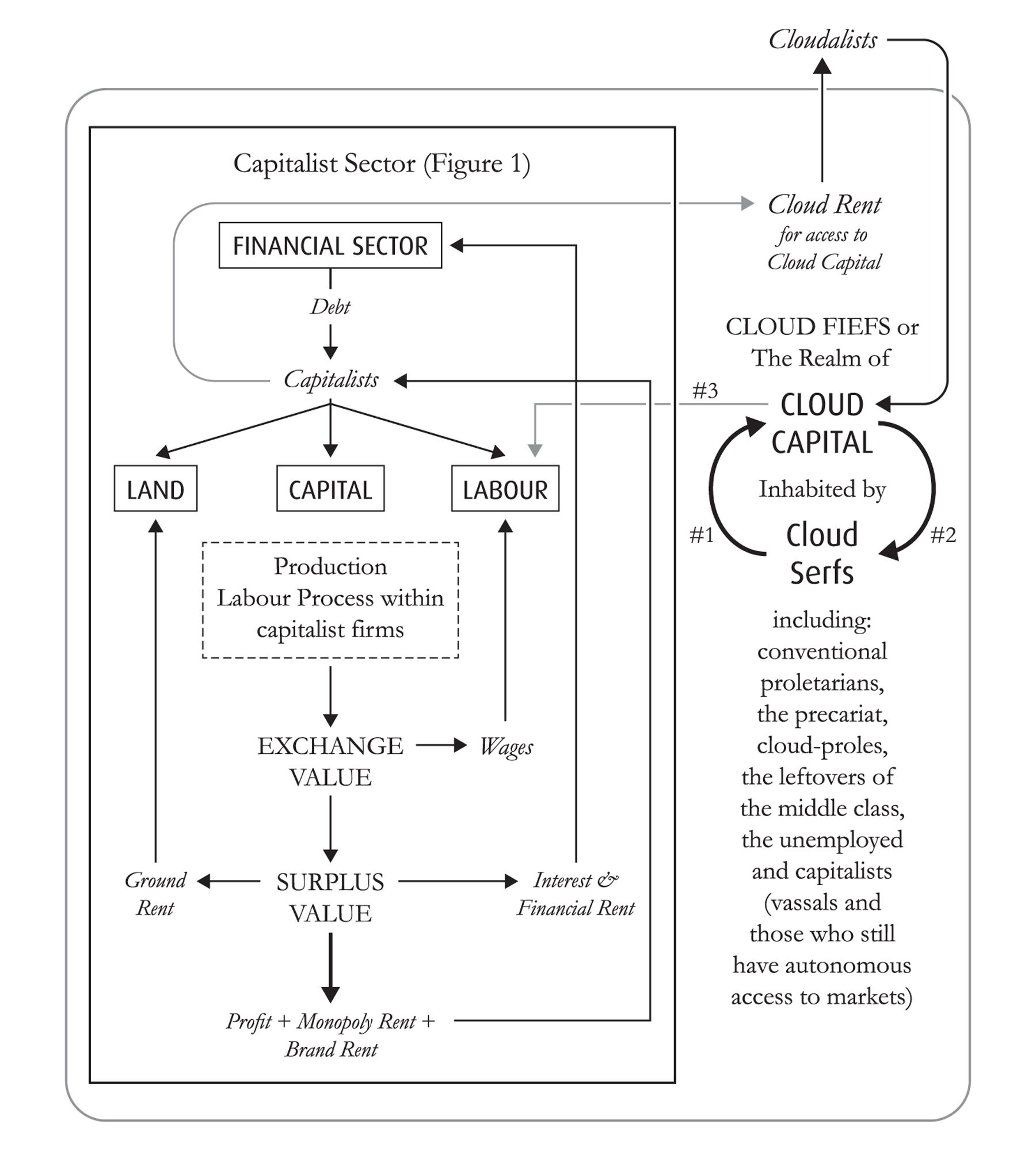

In the book, he tries to explain in 3 charts how the Technofeudalism is different from the capitalism:

1 Cloud-serf, unpaid labour helps reproduce cloud capital.

2 Cloud-capital modifies the desires, beliefs and propensities of cloud-serfs – including their consumer choices.

3 Cloud-capital also speeds up the work rate of waged labour within the capitalist sector

Furious intermezzo (not a musical one)

Also from one of my posts on Facebook, but without the screenshots proving the prices for the UK, DE and RO markets:

Why I’m all in favor of e-book piracy. Here’s an ePub at Kobo:

– UK price: 10 GBP = 11.55 EUR = 57.47 lei

– DE price: 18 EUR = 15.58 GBP = 89.53 lei

– Well, the motherfuckers are selling it in RO for 103.10 lei = 18 GBP = 20.73 EUR, and they even pretend they’re making you a favor, as the regular price was/is/should be 125.72 lei = 21.88 GBP = 25.27 EUR.

Why, it’s expensive to send some bytes to Romania. Or maybe we’re too rich to purchase cheap files. Who knows, while I was looking away, maybe they raised the VAT on e-books in RO to 80%!

Jerks, shitheads, motherfuckers at Kobo.

I considered buying this e-book; now I’ll wait for it to show up in the fine piracy places. When you look at what Kobo does, you can’t have any moral scruples — because they don’t have any!

There’s a way to beat this stupid geographically customized Technofeudalism:

- Go to this e-books page on eBooks.com, the UK version (where the price is 10 GBP).

- Add the book to the cart.

- Purchase it without an account (“Checkout as Guest”), then choose to create an account.

- While creating the account, enter a UK address and a UK zip code; I entered the post code for Buckingham Palace, which is SW1A 1AA.

- You will have created a UK account and you’ll be able to purchase UK editions at the original price!

Actually, the account can be created prior to purchasing. I just wanted to purchase the e-book first, just to be sure they don’t cancel the account, should something seem fishy to them. But I remember how in the past I have given fake US addresses to some other websites to be able to purchase e-books that were only available in the States! This is ridiculous:

- Should I order a US edition of a printed book from Amazon.com, they’d ship it anywhere in the world (except to North Korea, Iran, Cuba, possibly Russia now).

- Should I order an e-book from Amazon.com (if Kindle) or from any other US-based site… sorry, this cannot be done, please go to your national site! The same goes for e-books on any “national” site that isn’t “mine”! (On Kobo, even to create an account, say, for Italy, you have to use a VPN to get an Italian IP. Yes, I once needed to do such a thing, as the e-book I wanted was “for Italy only”!)

As if the ethereal bytes were much more “special” than the material paper. (“The first thing we do is, let’s kill all the lawyers.”)

Back to Technofeudalism

The next thing I did, after having watched the above videos, I read this interview in the Guardian: Capitalism is dead. Now we have something much worse’: Yanis Varoufakis on extremism, Starmer, and the tyranny of big tech. It’s actually from The Observer, which is a Sunday sister paper; this one was the Sept. 24 edition.

I was stunned to discover that Yanis Varoufakis “preaches” for Technofeudalism since… the middle of the pandemic, which explains why I didn’t pay attention to this topic. Here’s a collection of older references, as articles:

■ 2021-02-24: DiEM25 Communications: Capitalism has become Technofeudalism

■ 2021-04-30: «Das ist kein Kapitalismus, sondern Technofeudalismus»

■ 2021-05-16: Techno-Feudalism & the End of Capitalism – interviewed by Alice Flanagan for NOW THEN

■ 2021-06-28: Techno-Feudalism Is Taking Over

■ 2022-04-23: Discussing Crypto, the Left & Technofeudalism with Evgeny Morozov – CRYPTO SYLLABUS long interview (the same contents is available here)

Jeff Bezos, Elon Musk, et al. invest massively and are nothing like the lazy aristocrats of the original feudal era. But that does not mean that their investment is part of a standard capitalist dynamic. Techno-feudalism is not merely feudalism with gadgets. It is simultaneously much more advanced than capitalism and reminiscent of feudalism.

Let me be more precise. The massive investment of Big Tech that you mention is crucial. Not just because of its size but, primarily, because of what it produces: a new form of capital that I call command capital. What is command capital?

Standard capital comprises produced means of production. Command capital, in contrast, comprises produced means of organizing the means of industrial production. Its owners can extract huge new value without owning the means of industrial production; merely by owning the privatized informational networks that embody command capital.

Command capital, to be more precise, lives on privately owned networks/platforms and has the potential to command those who do not own it to do two things: Train the machines/algorithms on which it lives to (A) direct our consumption patterns; and (B) directly manufacture even more command capital on behalf of its owners (e.g. posting stuff on Facebook, a form of labor de-commodification).

In more abstract terms: Standard capital allows capitalists to amass surplus exchange value. Command capital, in contrast, allows techno-lords (i.e. Jeff Bezos, Elon Musk, et al.) to amass surplus command value. Command value? Yes: Any digital commodity has command value to the extent that its buyer can use it to convert expressive everyday human activity into the capacity to train an algorithm to do two things: (A) make us buy stuff, and (B) make us produce command capital for free and for their benefit.

In the language of Marx’s political economy, the magnitude of command value contained in any digital commodity is determined by the sum of: the surplus value of the commodities it makes us buy (see A above) + the labor time socially/technically necessary for us to produce a unit of command capital (under B above), to be appropriated instantly by the techno-lords.

In summary, what Bezos, Musk, et al. are accomplishing through their massive investments cannot be understood in terms of either feudalism or capitalism.

- Feudalism was based on the direct extraction of experiential/use value from peasants.

- Capitalism was based on the extraction of surplus labour from waged labour.

- Technofeudalism is a new system in which the techno-lords are extracting a new power to make the rest of us do things on their behalf. This new power comes from investing in a new form of capital (command capital) that allows them to amass a new type of value (command value) which, in turn, grants them the opportunity to extract surplus value from (i) vassal-capitalists, (ii) the precariat, and (iii) everyone using their platforms to produce on their behalf, unconsciously, even more command capital.

A side note to the last one: Yanis is fascinated by the technology behind the cryptoshit, specifically by Blockchain. I’m sorry to say that he should keep away from the technologies he cannot understand. Blockchain sucks. A lot. I’m surprised that an ecologist such as Yanis cannot understand at least this aspect of Blockchain: it’s a pointless black hole for energy! There are better ways to solve the problems that Blockchain pretends to be a solution for. As for other cryptocurrencies, more energy-efficient, they suck too.

I bookmarked back in 2022 the following video:  Crypto is dead | Yanis Varoufakis x Viktor Tábori x Brain Bar, to which I made the following notes:

Crypto is dead | Yanis Varoufakis x Viktor Tábori x Brain Bar, to which I made the following notes:

“Anti-Bitcoin economist”; “it cannot be money”; but the technology (Blockchain) is great. Fiat money. Watch the first 8m34s.

Also, an excerpt from another speaker, under the note, “Tábori just explained how the technology works, but he has no idea how money works…”:

Tony Wilson: As an engineer who has spent several years now looking into economists and how they think and WHAT MONEY ACTUALLY IS. I can say for certain Yanis is 100% CORRECT and Viktor hasn’t a clue.

Sorry, but Viktor has (like so many technologists) no idea about what innovation is or how what drives it. Like so many in the IT industry he’s completely wrapped up in the technology and because the technology is amazing then he’s mistaken that everybody must have it because it’s amazing.

This is actually a very common thing with technologists who do something new or who are involved in a new technological field. These are people generally doing something for the first time ever in human history, and it’s an intoxicating experience. As a result, they think their idea is the greatest idea humanity has ever seen. Like artists who hide in workshops, they are so intensely focused on their task they often suffer tunnel vision and lose perspective.

NOTICE how he struggles to stay on the topic and keeps reverting to how amazing the technology is, while Yanis is more “What does that mean for me or to me?” Like right at the end, where he points out that owning an NFT means owning a unique collection of 1s and 0s. Well how does owning that feed me, cloth me, keep me warm or cool me down? These are the things the pro-crypto people are NOT asking themselves. They have tunnel vision.

Unfortunately, but Yannis too has a tunnel vision. He’s not criticizing enough the crypto ecosystem. I suppose he believes he’s “modern” and open-minded, but he fell into a trap.

Closing the parenthesis, I’ll add some older (and newer) videos on the Technofeudalism thing:

2022-07-11: Stanford in Government (SIG): Technofeudalism and Cloud Capital: A Conversation with Yanis Varoufakis

2022-07-11: Stanford in Government (SIG): Technofeudalism and Cloud Capital: A Conversation with Yanis Varoufakis

2022-09-24: Singularity University: Techno-Feudalism & the Death of Capitalism | Feedback Loop ep 58, Yanis Varoufakis

2022-09-24: Singularity University: Techno-Feudalism & the Death of Capitalism | Feedback Loop ep 58, Yanis Varoufakis

These are newer:

2023-10-05: UnHerd: Yanis Varoufakis: Welcome to the age of technofeudalism

2023-10-05: UnHerd: Yanis Varoufakis: Welcome to the age of technofeudalism

2023-10-06: PoliticsJOE: Yanis Varoufakis explains how big tech is economically dominating your life

2023-10-06: PoliticsJOE: Yanis Varoufakis explains how big tech is economically dominating your life

2023-10-08: American Big Tech Has Enslaved Us | Aaron Bastani Meets Yanis Varoufakis

2023-10-08: American Big Tech Has Enslaved Us | Aaron Bastani Meets Yanis Varoufakis

My preliminary comment (I haven’t read the book yet!)

I always felt that the way the Capitalism went is going to screw us all, and there’s no valid analysis of the situation. “We need a new Marx,” I used to say. Or some out-of-the-box criticism, anyway.

Thomas Piketty was a disappointment, with his main books, Le Capital au XXIe siècle (2013), and Capital et Idéologie (2019). He identified some of the problems, including the idea that structurally, r > g leads to an ever-increasing concentration of capital, where r represents the return on capital, and g represents the growth rate; and that this is possibly the most important source of social inequality. Marx believed that the return on capital will ultimately fall to zero. However, the reality is different.

As capital dominates, the 1% are increasingly not entrepreneurs, but rentiers. That is, they’re people who do nothing and contribute nothing to the society; they inherit a fortune and live off the rent. In such a system, it’s not even worth it to study hard and increase your income as much as possible— it pays much more to just marry into money, so to speak. Does it sound as having elements of Technofeudalism to you?

The problem with Piketty is that he believes to have found the solution: a progressive tax on capital. No, really, this is everything he could come up with?

In this context, I remember having heard Eric Lombard, directeur général de la Caisse des dépôts et consignations, stating that the return on capital should not exceed 4%, despite the investors demanding returns of 8-15%, which is untenable. His evaluation was that on average, in a company, 15% of profits go towards capital, while wages increase by only 1.5%. This was very different even in the relatively recent past, such as the “glorious thirties” (1945-1973).

This isn’t bad as a general evaluation, but it fails to address the role played by recent technologies in reaching this point. And this is why Varoufakis was necessary.

BONUS: More of Varoufakis

In the context of the failing (in my opinion) European Union, there are two older videos you must watch:

- 2022-09-08: DiEM25: E63: Europe’s electricity market: the scam of the century?

- 2023-02-10: DiEM25: Yanis Varoufakis exposes Europe’s energy scam

I wanted to write a post about the last one, but I decided against it. Some people would fail to understand, anyway.

EXTRA BONUS: More about the demise of Europe and the rise of China

Let me present you Riccardo Ruggeri. He started as a workman for Fiat, being the son and grandson of Fiat workers. The managed to become, in time, the CEO of many Fiat companies, most recently of New Holland. Then he fell out of love with the direction taken by Fiat (FCA).

He wrote books such as: Parola di Marchionne; Fiat, una storia d’amore (finita) [English edition: My Love Affair with Fiat Is Now Over]; Una storia operaia (his most famous one); FCA: remain o exit?; Uomini o consumatori? Il declino del CEO capitalism; Il Signor CEO. Cinguettii dalla Città proibita; and novels (La terza guerra mondiale di Gordon Comstock; La pestilenza è finita. Sono tutti morti, quasi; Editoria & Amazon. Romanzo autobiografico; Il Processo di Achille K.; Maria e l’ingegnere – Il retrogusto del potere).

Now he’s an entrepreneur and publisher of Zafferano News, and he also writes a daily column in Italia Oggi. You can read more about him: Fiat, l’operaio diventato il primo Marchionne…; Riccardo Ruggeri: una vita al vertice. Oh, wait, there’s an English translation: Riccardo Ruggeri: a life at the top, although it’s quite rough and it doesn’t explain any of the cultural references, such as “fantozzian” (see Ugo Fantozzi).

Riccardo Ruggeri has the obsession of “CEO Capitalism”; by that, he means the evolution (?!) of capitalism after the fall of the Berlin Wall. Today’s capitalism has changed to evolve (and revolve) around the CEO, the supermanager who governs huge companies without being the owner and without the risks of the owner. Also, the “CEO Capitalism” has transformed everyone into a consumer. Nowadays, very little is produced, but very much is talked about. At the same time, a small group of “supermanagers” earn astronomical figures, whereas most people earn little or very little, but still enough to remain a serial consumer of food, objects and services that become of a poorer and poorer quality. (This doesn’t seem very different from the Technofeudalism!)

Part of his articles on Zafferano News, and also part of his tales about his friend who’s a Swiss banker, I will translate from his last installment, I “numeri” del banchiere svizzero XY sull’Occidente (I’ll skip the part about “If Switzerland were to become part of the EU, it would have become just another Belgium”):

In 2008, so just 15 years ago, Europe had a GDP of $16.2 trillion against the U.S.’s $14.7 trillion, while China’s figures were not significant. Today the U.S. has a GDP of $25 trillion, China $23 trillion (the overtaking will come before 2030) and Europe (without UK) just $16.7 trillion. Then the Euro was 1.60 Swiss Francs, today it’s 0.946.

In the coming years, Europe’s position will become even more critical, because it is absent in new technologies, the auto industry (we were number one) is now China-dependent (will the luxury segment remain?), the other remaining industries are highly energy-intensive but, with the sanctions following the war, have lost their main asset: the low prices and high quality of Russian gas (today they are supplied with embarrassing American gas that costs three or four times more or liquefied gas, partly Qatari and Russian).

Confirmation of Europe’s irreversible decline is shown by the fact that it is now dominant only in the luxury industry and lifestyle activities. Just like in the third century A.D., when Rome declined in military power and state wealth, but life in the Limited Traffic Zones of the ruling classes was highly refined and elegant, if morally corrupt. Exactly the same as today. This is the LTZ scenario of the Europe of the future, into which we have entered, with reckless boldness.

Interesting other numbers on the United States and China.

To circumvent the tariffs imposed by Donald Trump, and enthusiastically confirmed by Joe Biden, Chinese exports to the U.S. dropped by 15 percent from 2017 to 2022, but meanwhile Chinese exports to Southeast Asian countries (Indonesia, Malaysia, Vietnam, Thailand, etc.) exploded. That’s just one stage, then the Chinese product formally changes its shell and comes to Europe and the United States under another name.

The financial wizards of the G7 have not yet realized that these intermediate countries, with such ridiculous games, will become more and more dependent on the Chinese Dragon and the West will increasingly lose the political-economic influence, created over centuries. The same little game presents itself for the countries of the so-called “Global South,” read Africa.

XY’s conclusions, when the bottle of Merlot is finished, and so is the sgroppino, is always the same: “The sanctions and the price cap on oil suggested by our most rarefied elites have been a flop, first of all of a technical-cultural kind. We are ruled by full of diplomas, yet trivially inept individuals, convinced, however, that they are omniscient. Here in Switzerland, Anglo-Saxon super CEOs, to the sound of bonuses and stock options, gobbled up a jewel bank like Credit Suisse. The later we get rid of them, the worse it will be for us.”

2024 Update

Back in October, when Varoufakis’ Technofeudalism was out, I watched a dozen interviews with him. Now YT, this expression of the Cloud non-Capitalism, told me I missed a few ones.

2023-12-20, with “innovation expert” Tom Goodwin for Euronews: Capitalism as we know it is over, so what comes next? | My Wildest Prediction with Varoufakis.

2023-12-20, with “innovation expert” Tom Goodwin for Euronews: Capitalism as we know it is over, so what comes next? | My Wildest Prediction with Varoufakis.

Allow me to say that Tom is a bit retarded, or, more accurately, overconfident when addressing issues he knows nothing about. A crucial explanation on how this isn’t market capitalism anymore is given roughly between 15:30 and 19:00.

2024-02-15: PoliticsJOE: Capitalism is dead and so are we | Yanis Varoufakis interview.

2024-02-15: PoliticsJOE: Capitalism is dead and so are we | Yanis Varoufakis interview.

2024-02-07: Adam Conover: Capitalism Has Mutated Into Something Worse with Yanis Varoufakis – Factually! – 247.

2024-02-07: Adam Conover: Capitalism Has Mutated Into Something Worse with Yanis Varoufakis – Factually! – 247.

I love Yanis, but in the first video he’s eating shit twice: when he talks about climate change and when he says that the Blockchain technology shouldn’t be religiously worshiped or hated. OK, three times: he’s also too optimistic about what the so-called AI (which is not cognitive AI, but generative and hallucinating AI) can do. Blockchain is mostly a way to mindlessly consume energy, and most of its usages are not sensible. Basically, Yanis doesn’t understand technology, and he will never be able to fully understand the real value versus hype of: Blockchain, AI, Quantum Computing, and other gods of the moment. He’s too addicted to technology not to be enchanted by it, and he even admits that!

The second video introduces topics unrelated to the book, but worthwhile.

The third video introduces quite at the beginning the same argument I highlighted in the first video. By showing different products to different people, Amazon is maximizing its own profits, not the profits of the sellers; thus, this is not anymore market capitalism, but a trading place, a Cloud Fief, which profits to the renter, which is Amazon.

2nd 2024 Update

Henry Snow, labor historian and visiting assistant professor at Colby College, sharply criticizes Technofeudalism in the American socialist magazine Jacobin: We’re Still Living Under Capitalism, Not “Techno-Feudalism”:

…

Varoufakis compares this to the privatization of the internet — the move from the anarchic era of personal home pages and forums to the sterile holdings of Facebook. This comparison is apt — but presents a logical problem for his argument.

…

For internet privatization to instead produce a new feudalism, cloud capital would have to be structurally distinct from ordinary capital.In Varoufakis’s telling, data-powered “cloud capitalists” take capitalist power much further than ever before thanks to reinforcing algorithms, which aim to manipulate our behavior and leverage user data to optimize that manipulation: finding the most shareable content, the most effective advertisement, the most addictive videos. As we train devices like Alexa, Varoufakis ominously warns, they also train us — and while we could resist the mere human powers of twentieth-century ad men, Alexa’s “power to command is systemic, overwhelming, galactic.”

But is it? The primary purpose of much of cloud capital’s data is advertising. Amazon’s behavioral “control” of consumers is at best an effort to make us buy more things. Prime memberships, with their speedy turnaround, do encourage more purchases, and advertising data no doubt helps Amazon determine what products to sell. But Alexa certainly has not. Far from being an asset, Alexa has been a multibillion-dollar write-off.

Contrary to motivating narratives that might appeal to investors — which Varoufakis’s discussions of technology often seem to echo, only with the moral conclusions inverted — Alexa has proven impossible to monetize. … Despite salutary attention to the physical infrastructure behind the cloud, he takes all too seriously tech promoters’ promises of exponential growth. Time and again, these marketing narratives have proven hollow. Plenty of cloud capital is simply vapor.

Similar overstatements of the power in the hands of the “cloudalists” (Cloudalism would have been a better title and a better argument) arise as Varoufakis goes into the reproduction of cloud capital. He describes a system of “cloud proles,” exploited workers like those in Amazon factories, as well as “cloud serfs,” who freely produce the valuable data of cloud capital — think social media content or Google Maps information. As a result, tech firms capture vast revenue from unpaid labor, and the labor share of their income is an order of magnitude lower as a result. This is a new development and a significant economic shift. But it is not serfdom.

Users of social platforms, if we can still credibly call them that, exist on a spectrum between two poles, and both are closer to proles than serfs. First, we have consumers, who mostly view content while posting some to a small audience, and producers, such as influencers, whose primary activity is producing content and often selling products themselves. Consumer-users are not serfs: they really can leave platforms and do so all the time.

More importantly, producer users are not serfs either. They are stochastically waged laborers, paid with uncertain and shifting wages or the hope of receiving them in the future. Producer-users with the greatest market power bounce to other platforms for better terms quite regularly, while the masses with fewer followers seek what they can get as different platforms arise. All of this is decidedly capitalist.

…

By failing to attend to the actual movement of value within the firms he is discussing, Varoufakis misrepresents the shift they embody in the economy more broadly. He argues that we are entering — indeed, already in — a feudal world of rent-seeking fiefs powered by evolving cloud capital, not a profit-seeking world of markets anymore.In his account, cloud capital’s “power over our attention” enables it to charge commodity-producers rent — which he helpfully distinguishes from profit by defining rent as “not vulnerable to markets.” But the central business of cloud capital, advertising, is entirely vulnerable to markets and in fact itself constitutes a market.

Varoufakis’s defense against the obvious objection that cloud capital continues to engage in market competition is to characterize this as feudal conflict instead. All his examples suggest otherwise. He tells us that “TikTok’s success at stealing the attention of users away from other social media sites is not due to the lower prices it offers or higher quality of the ‘friendships’ or associations it enables,” and that it instead “created a new cloud fief for cloud serfs in search of a different online experience to migrate to.”

But the defining feature of serfs is that they do not freely migrate, and the very reason users migrated to TikTok was famously because of its eerily effective algorithm — in other words, because it competed effectively in the market. Varoufakis tells us that Disney Plus has competed with Netflix only by offering different movies and is thus engaged in feudal rather than capitalist conflict.

Yet competing on content is no less market competition than competing on price. By this standard, Coca-Cola and Pepsi would be feudal, simply because they too have a monopoly on their own intellectual property. Likewise, Varoufakis is wrong when he says “search results are not produced to be sold” — they are, literally, sold to advertisers.

…

Capitalists have long attempted to reach escape velocity and become immune to market competition; they have also long failed. Social networks continue to compete for our attention, and cloud “content” must compete for our time. It would be easy to continue listing examples from Varoufakis’s account and explaining exactly how they rely on markets and profits rather than feudal rents. What matters is this: from ads to share prices, the imperative to compete is as foundational for cloud capital as other capital.

…

Varoufakis’s misdiagnosis of our political economy leads to a confused and unhelpful theory of social change.

…

He argues politics is no longer defined by conflict between labor and capital. Instead, we have identity politics, which in his view favors cloud capital across the political spectrum: the “alt-right” receives algorithm-magnified white supremacy while the Left receives class-blind Diversity, Equality and Inclusion lectures. … We also get an unnecessary (and, speaking as a nonbinary person, upsetting) parting shot at the Left’s “civil war on the definition of a ‘woman,’ which feels inconsistent with Varoufakis’s own clear defenses of trans rights elsewhere.

…

Because markets are dead and identity politics are divisive, Varoufakis encourages a new coalition based around shared experiences of techno-feudal exploitation connecting “cloud proles,” “cloud serfs,” and “at least some vassal capitalists.” Together they could engage in “cloud mobilization” for democracy and economic equality.As an example of anti-techno-feudal action, Varoufakis suggests a super Panama Papers–style leak exposing “the hidden digital connections between cloudalists, government agencies, and bad actors like fossil fuel companies.” I suspect he is overestimating the number, magnitude, and significance of hidden connections here due again to his dismissal of capitalism. “Cloudalists” and capitalists in general are a class that exploits primarily through market power, not individuals who rule by conspiracy — no matter how much corruption and malice is involved in class domination.

…

Consider another example of cloud capital from the video game industry: Valve Corporation, ironically Varoufakis’s former employer, uses the market dominance of its Steam PC gaming platform to take a whopping 30 percent cut of all sales from vassal capitalist gaming companies. The largest of these firms still rake in billions, while forcing many of their underpaid workers into mandatory “crunch” overtime. A traditional left analysis of capitalism suggests an alliance with these workers, starting with helping them unionize. A techno-feudal analysis would instead point toward an alliance with their bosses.

…

The few concrete suggestions Varoufakis offers for “cloud mobilization” further indicate the limits of consumer action. Outside of the aforementioned super-leak, all of them are market-based actions. He proposes a hypothetical one-day boycott of Amazon that would “push Amazon’s share price down in ways that no traditional labor action could achieve.”This would invariably fail due to the same market competition Varoufakis tells us is dead: Amazon’s market dominance is dependent on its exploitation of warehouse and delivery workers, which drives down costs and delivery times. Any competitor would use an increase in its own market share and investment to rise to, and then exceed, Amazon’s current level of worker exploitation. This is the terror of capitalism: whatever the worst person in the world is willing to do and able to get away with, markets encourage. Whenever anyone, executive or worker, says no to any kind of exploitation, the profit imperative empowers someone else who will say yes. Boycott strategies based upon shifting who we say yes to cannot liberate us.

…

Rejecting capitalism will require us to reject market power and imagine a world without it. Varoufakis’s preferred future, presented here via adaptation from his 2020 book, Another Now, instead embraces them, advocating an economy of “democratized companies” that enable “truly competitive product markets.”While socialists can and should disagree over the proper role of markets in organizing economic activity, that debate is useless if it begins from a mistaken idealization of “true” competition. Varoufakis wants a commons, where human beings make decisions instead of algorithms — a world where decisions like the Greek people’s 2015 rejection of EU-imposed austerity can matter. We all should and we can be grateful to have a comrade like him. But the opposite of a commons is still a market.

This guy makes some valid points, but he’s not without flaws. First, he’s “speaking as a nonbinary person,” which is bollocks. The so-called nonbinary persons are insane. If he has dangling external sexual attributes in the groin area, then he’s a male, full stop. However, Varoufakis is indeed absurd to insist on the alleged “hidden digital connections between cloudalists, government agencies, and bad actors like fossil fuel companies.” Fossil fuel companies, really?

I added links to two more videos, and a few comments.

Oh, I found a nonbinary American socialist who insists that Technofeudalism is just another form of capitalism.